» Medicare Advantage Plan: The Luxury of Finding Yourself the Best Plan

Medicare advantage plans bring the best of health services combined into one package. It includes all the benefits of Original Medicare (Part A and Part B). Some plans may also cover Part D (Prescription Drug Coverage) at no additional costs. The dental, vision and hearing checkups are also covered under this plan. You have always heard about people walking an extra mile to help others. The time has come for you to experience it.

An advantage plan is entirely different from Supplement insurance. A Medicare supplement plan works as an added security layer to provide coverage all the health conditions which were not covered in Medicare Hospitalization (Part A) and Medicare Insurance (Part B). However the advantage program works on its own.

You do not have to pay premium for Medicare Part A but what about Part B? You are required to pay Part B premium, as you have been doing so far. The monthly premium for advantage plans is also there to be paid separately.

Different types of Medicare Advantage Plans:

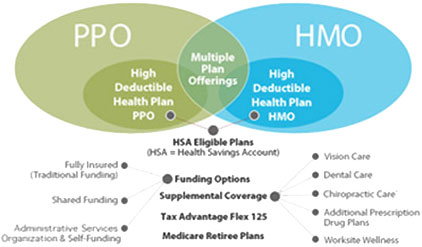

Health Maintenance Organization (HMO):

Benefits of Health Maintenance Organization (HMO):

- It offers more benefits than the Original Medicare and Supplement insurance combined together.

- A wider network of doctors and medical hospitals available.

Disadvantages of Medicare HMO Plans:

- A wider network but restrictions still make a large part of the whole functioning procedure.

- You need to get an approval in case you are going out of the HMO network in advance.

(You need to check the service area for the respective plan. It can change from county to county).

Health Maintenance Organization with Point of Service Option (HMO PSO):

This is considered to be a perfect plan. It provides a lot of options, to say the least. You can choose medical facilities outside the HMO network (only in certain medical conditions). There may be an extra amount to pay for it.

Benefits of Health Maintenance Organization with Point of Service Option (HMO PSO):

- You can opt for Medicare outside the preferred or approved network. It enables you to plan things swiftly.

Disadvantages of Health Maintenance Organization with Point of Service Plan:

- There may be additional costs attached to it. It is not available to each and every single person but only applicable in certain cases.

Preferred Provider Organization (PPO):

There is a network of doctors and hospitals available. It has taken a step further into the future. You can also opt for any doctor or hospital in the country of your choice (outside the network). So, both the options are available to be benefitted from.

Benefits of Preferred Provider Organization (PPO) Plans:

- Choose the doctor or medical centre of your choice within the country.

Disadvantages of PPO Plans:

- There is a price for it, in case it was not mentioned earlier. There is a higher amount of coinsurance to be paid.

Private Fee-For-Service (PFFS):

The respective Medicare advantage plans have a slightly different working structure. You can visit any doctor or hospital which accepts the terms and conditions of the plan.

Benefits of Private Fee-For-Service (PFFS) Plans:

- You can get medical emergency services anywhere, anytime in the country. There is no need to get any kind of (pre)approval done for it.

Disadvantages:

- The doctors or hospital authorities can decide whether to accept it or not. There are extra costs involved in it.

Medicare Special Needs Plans (SNPs):

The plan is meant for those who are suffering from a specific form of chronic diseases (Neurologic disorders and diabetes etc). Patients get all the medical treatment and benefits covered in one plan. It must include Medicare Part D (the Prescription Drug Coverage) as one of its primary elements.

Benefits of Special Needs Plans (SNPs):

- People who are suffering chronic diseases are the biggest beneficiaries. They are better served by finding everything combined into a single package.

Disadvantages of SNPs:

- It is not meant for all the people looking for such a plan. It is clearly stated or mentioned in the list.

Medicare Medical Savings Account (MSA):

This program has a unique working system. You are entitled for a Medical Savings Account (MSA). A certain amount of money is deposited every year into it. There are higher out-of-pocket costs involved as a part of the program. It would cover all Medicare-approved expenses, once you reach the deductible.

The deposited amount would not be taxed as long as you are using it to spend on Medicare-approved services.

Benefits of Medical Savings Account (MSA):

- Medicare pays the monthly MSA premium for you.

Disadvantages:

- There is no Medical Part D (the Prescription Drug Coverage) available.

You have been given a set of different options. The good part is that you can always check and compare things in order. There are different aspects to be taken into consideration before making any decisions here.

Medicare advantage plans present six interesting options. There is a plan designed and made for everyone in the list. You need to find the one which suits you the most.

rd/910/200/04032012