Medicare Supplement Plans Offer Customized Health Care Solutions

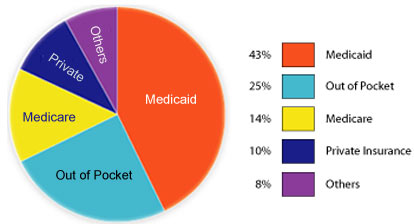

Medicare supplemental insurance has become an indispensable product for the senior citizens. The old age brings along a series of threatening health problems to encounter. There is no guarantee that what has not happened would never take place in the future. You should start planning things in advance.

Medicare supplemental plans provide an underlying sense of security as most of the health care expenses are covered in it. The modern day lifestyle habits have taken its toll on our health standards. You should cover all the risks by enrolling in a Medicare supplement plan. Original Medicare has certain restrictions to it. We find it to be under-performing at times.

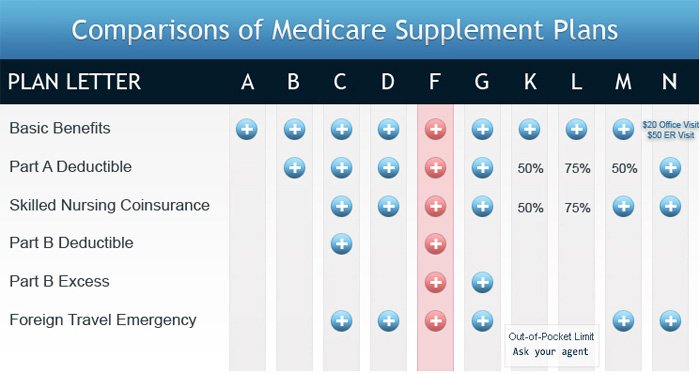

You should look for customized solutions to be better prepared. There are ten different Medicare supplemental plans (Plan A to Plan N). There is no dearth of opportunities, to say the least. You should have a clear picture in mind. Each plan has been created to meet specific requirements.

What points to consider while buying Medicare supplemental plans?

You can expect all private insurance companies to provide the same list of benefits. These plans are regulated by the Federal government.

You would still find rates to be different. You should check and compare the insurance quotes online. It comes out to be one of the decisive factors in the end.

The pre-existing health conditions have a bigger part to play than expected here. It is for sure that no insurance company would like to take risks when it comes to offering plans to those who are suffering from certain diseases for a long period of time. Where does it lead us to?

The Open Enrollment Period beginning from the day you turn 65 is a safe route to save yourself extra money by applying for Medicare supplemental plans. The insurance companies cannot go against the rules. They have no other option but to accept the application and move on with the process.

Narrow Down The Search to Key Aspects:

You should read each Medicare supplemental plan separately to find its good and not-so-good points. There is no other way unless you are an expert on the subject. It is about your health and your life. You are supposed to pour your heart and mind into it.

You have a fair idea that Medicare Part B has a monthly premium to it. There is separate amount of premium to be paid for it. Almost all the private insurance agencies (try to) make these plans available at no extra cost ($0).

You can take the services of a professional agent to find the best deals for you. There is no point in burning your hands while trying to learn something new. You can capitalize on someone else’s experience here.

The changing lifestyle patterns have spread awareness around in the neighborhood. People are more concerned and cautious about their health. They do not want to take things for granted. It is an ideal way to make a new beginning in life. It does not cost much. The amount of money paid every month is considered to be more of an investment than taking it as an expense. This is what old age is all about. You can take better decisions with all the experience gained over a period of lifetime.

rd/551/70/04162012